Allocating Properly: Trunk (safety) Stock in Combination w/ Consignment Inventory

Sales reps and ops teams in the medical device industry face complex challenges.

Unique to the medical device last-mile supply chain is the fact that sales reps often carry inventory stock with them on a full-time basis as safety stock or as part of the overall fulfillment process.

This “trunk stock” inventory is hard to track, difficult to manage, and even harder to allocate properly. Combine that with local field office inventory, central loaner inventory, and clinical consignment inventory and this multi-variable situation can spiral out of control very quickly.

Yet, the right software can enable better processes and provide advanced data for more accurate models.

What should I keep as trunk stock?

https://www.movemedical.com/properly-allocating-medical-device-trunk-stock/(opens in a new tab)

In previous articles, we discussed demand-based asset optimization from the perspective of a medical device field office and calculated the optimal inventory levels given demand signals from the field. Next, we went on to discuss the perspective of a hospital and looking at consumption patterns to determine what inventory should be consigned at the given location and what should be returned.

A perspective that we have not yet discussed is trunk stock and the role a rep plays in determining how much inventory to hold. Typically, reps and/or sales teams carry some inventory between what is consigned at a hospital and what is supplied by the field office.

Many organizations fail to analyze this data because the aggregation of consumption by sales team isn’t a commonly used perspective in ERP sales analysis. Movemedical’s case structure enables our clients to review their data from a Sales Team perspective down to the individual coverage rep associated with the surgery.

Data Collected

The Move platform allows for every item to be individually tracked and serialized even though there may be items in the system with identical lot numbers. As well, every inventory interaction is recorded. This atomic stock allows us to create incredible insights and analytics.

For this model we collected historical implant consumption data for a sales team at a SKU level by location in the pacific northwest. We collected the consumption at a daily and weekly level in addition to the volatility associated with the consumption. We are exclusively looking at a sales team where sales and efforts are distributed amongst multiple locations as opposed to highly concentrated in one or two large facilities. A sales team who supports many ambulatory surgery centers would benefit much more from trunk stock than a team who supports only a handful of facilities.

There are two major challenges OEMs face when modeling consignment data.

- The first challenge is accuracy of inventory physically at the site.

- The second challenge is organizing the data in a manner that clinically relevant to the sales reps and physicians whom this modeling directly impacts

Move solves the first by enabling field operations to simply and effectively manage their assets. This leverages Movemedical’s automation, atomic stock, and focus on user experience. This focus drives best-in-class user adoption in the SaaS space as discussed in previous articles.

Model

The second challenge is solved using data structures such as kitting, bundling, and nonstockable kits to organize the loose piece inventory commonly found in customer accounts. By organizing the data in this surgically-relevant method, we drive adoption of consumption-focused analytics that bridge the gap between corporate analysts and field operators.

We approach trunk stock modeling in three different steps:

- We model consignment at a facility level for a specific sales team.

- We run a trunk stock only model to demonstrate how much inventory would be required if everything was run from trunk stock.

- We bring the two models together and show which items should be consigned at a facility and which should be put in trunk stock with the sales team.

This approach will demonstrate that some assets that aren’t justified at a facility level can be justified at the team level. For example, a surgeon can work at several smaller surgery centers which individually don’t justify consigned inventory but if you combine them together at the team level inventory can be justified.

The confidence levels were also adjusted between the different models. At the facility level we elected to use a confidence level of 85% and subsequently increased that to 95% at the sales team level ensuring the additional levels of backup had higher confidence.

Results

Facility Consignment Model

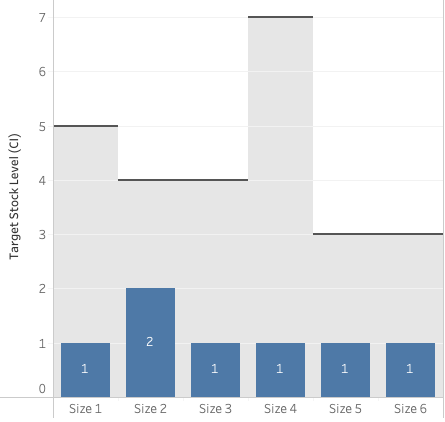

In the chart below we are looking at a standard implant kit sizes 1-6. The blue bar shows us the consignment model recommended inventory level for this location and then black line shows us the current inventory level at this location.

Figure 1: Tibia base plate kit consignment model for a facility

Our consignment model shows a full flat set is recommended at this location, compared to traditional consumption models which only consider individual SKUs, Move’s model will always place a flat set first if the consumption behavior at the facility recommends it even though the less frequently used sizes like 1 and 6 would see lower consumption.

Further, the consignment model recommends doubling up on size 2 due to higher consumption on that specific size. Item 4 was just shy of an additional piece of inventory due to slightly lower average demand and volatility. We expect the consumption of kits to be normally distributed with less consumption in outlier sizes and more consumption towards the mean. Size 3 stands out to us because it has significantly lower avg consumption and lower volatility than the adjacent sizes. We discovered that size 3 had significant backorders driving interoperative decisions for alternatives, which normally would be to downsize, and this reflected in inflated consumption in size 2.

The black line in figure 1 shows the current stock level for a standard kit at a specific facility. This location is carrying quite a lot of inventory compared to the volume. The sales team in this analysis covers roughly 30 facilities and the consignment model only recommended 2 of these facilities carry inventory.

Trunk Stock Model

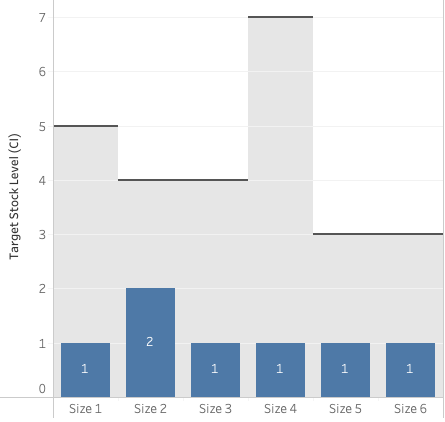

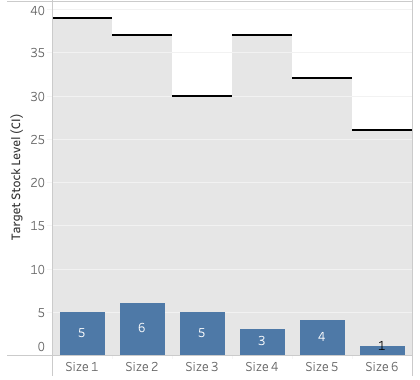

In the trunk stock model we assume there is no facility consignment and all facilities are supported by rep trunk stock. Similar to figure 1 above, the blue bar shows us the recommended stock levels for trunk stock and the black bar shows the aggregate inventory available at all facilities the team covers. We also increased the confidence level to 95% because multiple facilities relying on this inventory. Figure 2 essentially illustrates that if all inventory for these locations was aggregated at the rep level, significantly less inventory would be required to support the consumption at these locations. For example, size 1 has almost 40 implants amongst the 30 facilities, compared to the 6 required according to the trunk stock model, which would result in significant inventory savings.

Figure 2: Tibia base plate consignment model for trunk stock

Combining Trunk Stock and Consignment Model

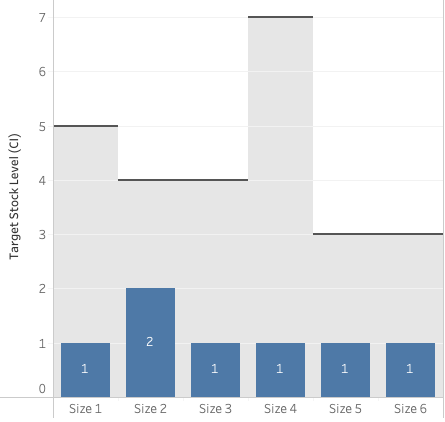

We can bring the two models together by sequentially running them. The idea here is that the consignment model consumes inventory first and any remaining consumption would come from trunk stock acting as a safety stock buffer. The left graph on figure 3 shows the total aggregated facility consignment for inventory at 2 out of the 30 locations, and the view on the right shows the trunk stock inventory to meet consumption requirements for the other 27 locations and the additional consumption from the first 2 locations when consigned inventory was insufficient and safety stock had to be used. If we compare the trunk stock only model to the combined models trunk stock we can see a decrease of only 3 implants on sizes 1,2 and 4 driven by placing consignment at the two facilities.

Figure 3: Combined Consignment (Left) and Trunk stock (right) model

Discussion

We ran 3 different models in this analysis, consignment only, trunk stock only and a combination of trunk stock and consignment. We found that only two facilities under this sales team justify some inventory of the standard kit, and the remaining inventory can be aggregated and significantly less can be used to cover consumption at 95% confidence. As we move further away from surgery consumption behavior becomes less volatile but also more efficient. The downside is that operational expenses such as transportation, shipping, facility and labor costs will increase. By moving items to trunk stock, we increase our confidence in stock availability whilst lowering our E&O exposure.

A downside of mobile stock is the additional liability it brings to the corporation. This includes keeping track of where implants are but also the risks of exposing sterile-packed implants to thermocycling and high humidity. Lastly, it needs to be determined whether sales reps are purely sales focused or are they inventory managers in a trunk stock ecosystem. Ultimately it needs to be a balance between sales and service, but the corporation should define this. If trunk stock is currently not used, some behavioral modification and change management will be required for its implementation.

When consulting with our medical device partners the number one cited constraint for growth is lack of inventory. The data would argue that there is plenty of inventory, but how the inventory is managed is the number one barrier to growth. Historically, the emphasis for inventory management has defaulted to the sales organization. Couple that with the shift in surgical procedures to surgery centers, which has added significant logistical complexities. Med Device companies are going to have to grapple with how they handle this business shift. To maintain the current sales support model it will require additional inventory. To combat inventory increases organizations will have to shift their focus to the optimization of inventory, historically not a skill set associated to a sales focused individual. Stack on the regulatory and compliance implications of a controlled device these organizations are going to have to take a clear stance on how they approach the market.

Conclusion

In the end there are many options that allow a med device company to support their customers. The one thing that is certain is the business model has changed and those who focus on the strategy of HOW they manage their inventory will be in the post position for sales growth.

Next Steps

Data is awesome. The right data can change your life. Well, at least your business…

If using next-level analytics to power you operational excellence efforts makes sense, reach out:

info@movemedical.com / call 877.469.3992

or watch this VIDEO (executive case study)